Algorithmic Trade: What exactly is it, Instances, & Algo Trade Actions

Limitation trade brands to make certain you’re also risking no more than step 1-2% of your own balance on one trade. These advantages emphasize the necessity of automation for making probably the most of arbitrage possibilities on the forex. This process spends automatic systems to identify and take benefit of temporary costs openings within the currency pairs.

How Arbitrage Works

AI exchange bots and you will automatic crypto trading spiders are even more put to save speed with this consult. The newest cloudsegment provided the market industry within the 2024, inspired from the scalability, cost-overall performance, and large method of getting cloud-centered trade programs. Cloud structure allows quick deployment away from AI models, real-time investigation control, and you can collaborative development of trading tips. Financial institutions make use of shorter It over and increased self-reliance in the scaling functions. The fresh use out of cloud options speeds up development and you can supporting the newest combination away from complex statistics on the change workflows.

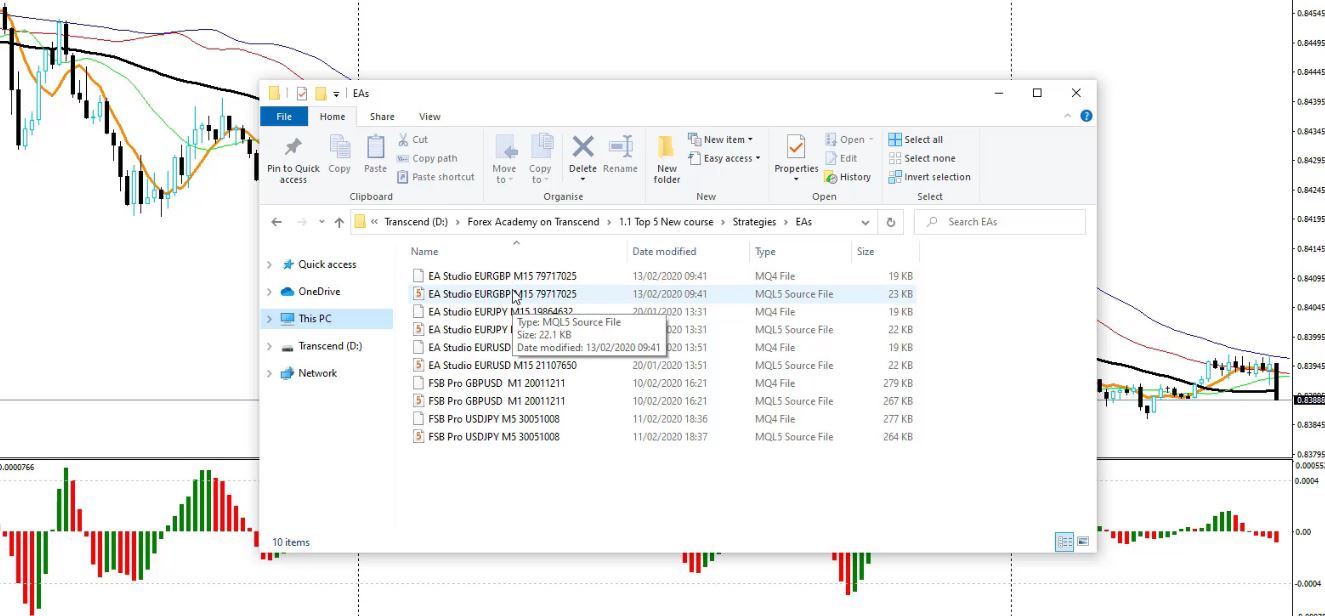

Trade Programs and you can APIs

Algo change, especially the type driven by the state-of-the-art AI, is actually a complicated community that needs a new set of skills inside the coding, study investigation, and you can financing. Better, even from a take on the brand new sidelines, you need to know how algorithmic trading https://www.visitcampia.pt/?p=24020 influences the new locations. This type of algorithms can affect inventory cost and market volatility, doing ripples one to eventually touch our very own profiles. Algorithmic change is a financial investment means very often is comparable to a one hundred-meter dashboard more The new Fool’s common means of constant enough time-label ownership of the market leading-bookshelf high quality companies. But even though you will most likely not thinking about lacing upwards to own a keen algorithmic change dash, information it is type in today’s world out of paying.

Such, in case your price of a stock differs between a few transfers, an enthusiastic arbitrage formula tend to choose the all the way down-priced inventory and sell they in the highest rates, benefiting from the real difference. The brand new regulating authorities after placed circuit breakers to avoid a flash crash from the economic places. However they averted algo-trades out of which have immediate access to the transfers. It’s the approach you to definitely monitors the typical good and the bad away from a stock, helping investors select whether or not to devote to a pals’s stock or otherwise not. In accordance with the average action in the costs, the software program establishes the cost that is probably to get the new holds from the a certain exchange.

Real-day market investigation involves the carried on research from trade study while the it gets offered. Rather than traditional steps one to rely on historic graph analysis, real-day study parses live channels away from field investigation so you can surface manner, defects, and you will entry/exit indicators with just minimal slow down. Regulating service to possess fintech innovation plus the need for genuine-date processing after that sign up to the marketplace’s growth. Such as, inside November 2024, SEBI create an appointment papers suggesting amendments to help you established legislation to help you target the brand new expanding access to AI and machine studying devices by the industry people. The fresh advised alter make an effort to present obvious accountability for agencies deploying including tech, guaranteeing he is accountable for analysis confidentiality, shelter, as well as the ethics out of investor advice. Such write amendments highlight the necessity of using strong governance tissues and you may clear disclosures regarding AI use.

Products for instance the infinity grid bot accommodate proper variety rebalancing throughout the years. For buyers dealing with your entire replace profile under one roof, having fun with a good good system for example 3Commas is also improve performance. Lowest latency queues for example RabbitMQ and you may genuine-go out database such Redis usually are used in code approaching to help you ensure punctual effect. These types of infrastructures improve the efficiency of automated trade bots doing work inside the highly volatile industry standards. Including, spiders playing with Kafka the real deal-date research pipes usually surpass those individuals having fun with group-centered cron schedulers.

United states’s popularity try strengthened by their investment places and you can skill pond. One advice posted because of the team of IBKR otherwise a connected company is based up on advice which is thought to be legitimate. Although not, none IBKR nor the associates warrant their completeness, accuracy otherwise adequacy. IBKR cannot make representations otherwise warranties concerning the earlier or upcoming overall performance of any financial instrument. By send issue for the IBKR University, IBKR is not symbolizing one to one form of monetary software or exchange method is suitable for your.

Performance Optimisation

Just after an investor has the foot lower than them, moving forward focus away from learning how to optimizing procedures techniques is considered the most the newest hallmarks of a smart tactician. Algorithmic change, known as automated trading, black-package trading, or algo trading, are a powerful device to own state-of-the-art traders who may have gained tremendous prominence lately. On this page, we’ll mention a guide to algo trading, investigating the definitions, record, positives and negatives, in addition to some common steps as well as the scientific criteria required to help you speed up the investments. Really formulas apply a global decimal study, carrying out trades if the asset’s trade pursue a certain pattern.

Algorithmic trading identifies automated change where traders and you can buyers enter and you can log off positions when the brand new standards match as per the fresh computerized tips. The new options try coded having instructions to handle deals immediately as opposed to person input. It conserves long to own people who will get much more about investments using their quick execution go out.

- As more electronic segments opened, other algorithmic trading tips were launched.

- Choosing the right algorithmic change software program is another essential said.

- It can be lessened to some extent simply by expanding the amount of indications the brand new algorithm will want to look to have, but for example a listing can’t ever become done.

- Mathematical spends statistical patterns to spot and act on the mispriced property.

- Since the i generally determine obligation when it comes to as to why something is felt like, that isn’t a topic away from court and you can ethical obligations within these options.

Inside the now’s quick-swinging crypto areas, people who can act instantly to shifting industry figure features a clear edge. The newest opportunity for successful positions often shuts in the moments, especially throughout the episodes of high volatility. That’s where artificial intelligence (AI) comes in—automating real-time investigation processing, generating actionable knowledge, and executing trades which have precision. The brand new organization people part added the market industry within the 2024, supported by their extreme exchange amounts and you will info to deploy cutting-edge AI-determined steps. Institutional participants, for example hedge financing and you may investment managers, control AI to maximise exchange delivery, perform chance, and you can make leader in the very competitive locations. Its adoption from trading tech pushes advancement and sets industry criteria.